Economic

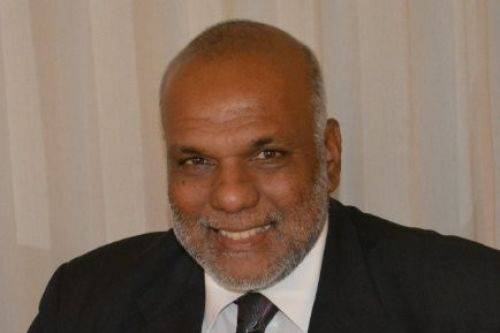

Highly respected economist and former Governor Dr. Indrajit Coomaraswamy yesterday confirmed that he is not keen to return to the Central Bank and backed the incumbent Dr. Nandalal Weerasinghe.

- Details

රුපියල් මිලියන 90,000ක් වටිනා භාණ්ඩාගාර බිල්පත් වෙන්දේසියක් මැයි 25 වනදා පැවැත්වීමට නියමිත බව වාර්තා වේ.

- Details

රට තුළ පවතින අර්බුදකාරී තත්ත්වය හේතුවෙන් ඇඟලුම් කර්මාන්තශාලා සියයට 30 ක් පමණ මෙරටින් ඉවත් කර වෙනත් රටවල ස්ථාපිත කිරීමට එම කර්මාන්තශාලා ප්රධානීන් සූදානම් වන බව වෙළඳ කලාප සේවකයින්ගේ ජාතික මධ්යස්ථානය පවසනවා.

- Details

ශ්රී ලංකාවේ ණය ශ්රේණිගත කිරීම යළි පහත හෙළා තිබෙනවා. ඒ, ගෝලීය ණය ශ්රේණිගත කිරීමේ ආයතනයක් වන ෆිච් රේටිං ආයතනය විසින්. ඒ අනුව ශ්රී ලංකාවේ දිගු කාලීන විදෙස් විනිමය ශ්රේණිගත කිරීම C ශ්රේණියේ සිට RD දක්වා පහත හෙළීමටයි ඔවුන් කටයුතු කර ඇත්තේ.

- Details

More welfare measures with sharp cuts in capex

Says economic policy framework that enshrines economic rights would be included in the new Constitution

Treasury to undertake structural reforms based on competitive social market economy

- Details

The Central Bank has imposed 100% cash margin on selected on-essential and non-urgent imports with immediate effect.

- Details

Two-week grace period for individuals and entities to deposit foreign notes in a bank

CB Chief describes grace period as win-win to forex hoarders and economy

Asserts yet to finalise on retaining $ 15,000 limit or reduce to $ 10,000

Says initiative to provide extra rupees for foreign remittances is unfair by taxpayers

- Details

Stresses exports as the only sector with steady foreign inflows to keep economy afloat

Opines SL cannot grow as a country without exports

Calls on all State institutions to support exporters to boost forex earnings

Hails resilience of exporters for $ 1 b plus monthly performance in past 10 consecutive months and reassures continuous support to private sector

Seeks to introduce mechanism to resolve power and energy crisis without further delay

Asserts delay to implement solutions could cause $ 50 m daily export revenue loss

Notices rapid brain drain in service export sectors

- Details

Says such rules necessary given the dire need of dollars for essential imports

The Central Bank last week disclosed that it collects every month up to US$ 300 million from exporter dollar conversions and surrender requirements, which helps significantly to provide dollars to finance the essential imports such as fuel, cooking gas, medicines and other commodities which are in

short supply.

They said doing away with the requirement could lose even the little amount that is being collected and thus would further aggravate the dire situation prevailing in the country.

Merchandise and services exporters in Sri Lanka are mandatorily required to repatriate all their export proceeds within 180 days of the date of shipment or provisioning of service, and are mandated to convert their residual proceeds after meeting several payments required to be made from foreign currency on or before the 7th day of the following month.

- Details

පුද්ගලයෙකුට සන්තකයේ තබාගත හැකි ඩොලර් ප්රමාණය අඩු කිරීමට ශ්රී ලංකා මහ බැංකුවේ අවධානය යොමුවී තිබෙනවා. මහ බැංකු අධිපති ආචාර්ය නන්නදලාල් වීරසිංහ 19 පැවති මාධ්ය හමුවකදී පැවසුවේ මේ වන විට පුද්ගලයෙකුට සන්තකයේ තබාගත හැකි ඩොලර් ප්රමාණය 15,000 සිට 10,000 දක්වා අඩු කිරීමට සාකච්ඡා ආරම්භ කර ඇති බවයි.

- Details

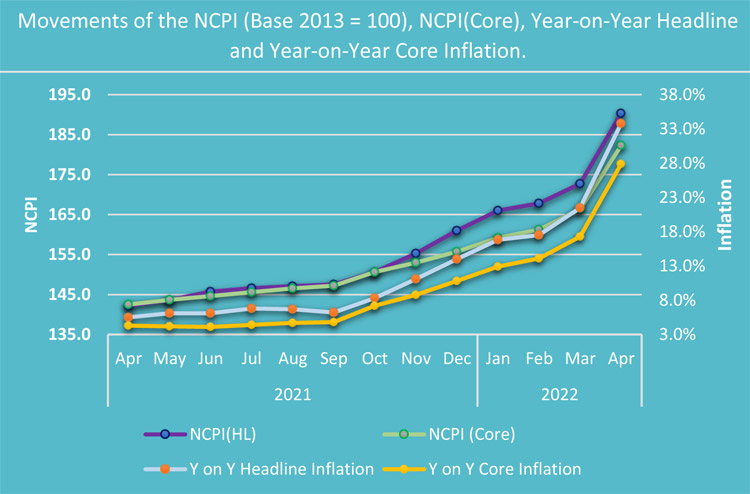

ජාතික පාරිභෝගික මිළ දර්ශකයෙහි වාර්ෂික ලක්ෂ්යමය වෙනස මගින් මනිනු ලබන උද්ධමනය ඉකුත් අප්රේල් මාසයේදී සියයට 33යි දශම 08ක් දක්වා ඉහළ ගොස් තිබෙනවා. ඒ, ඉකුත් මාර්තු මාසයේ පැවති උද්ධමන අගය වූ සියයට 21යි දශම 05හේ සිටයි. මෙලෙස උද්ධමනය ඉහළ යාම සඳහා ආහාර සහ ආහාර නොවන කාණ්ඩ දෙකෙහිම අයිතම වල මිළ ගණන්හි සිදු වූ මාසික ඉහළ යාම් හේතු වූ බවයි ජන හා සංඛ්යා ලේඛන දෙපාර්තමේන්තුව පවසන්නේ.

- Details

April remittance income at US$ 249mn, down 52% despite 80% depreciation of the rupee

Migrant workers continue to repatriate moneys via informal channels seeking higher rates

Cumulative remittance income in first 4 months down 57% to US$ 1.03bn

- Details

Page 105 of 268