Economic

Ahead of the winter season and a one-year break from physical engagement at global trade fairs, Sri Lanka Tourism has set out plans to undertake a series of promotional activities at top travel events in France, the United Kingdom and Germany this year.

- Details

Tea exports in August have increased by 16% to 25.48 million kilos and cumulative first eight months performance rose by 8% to 187.57 million according to Forbes and Walker Tea Brokers.

- Details

The Finance Bill which provides several tax amnesties was certified by Speaker Mahinda Yapa Abeywardena yesterday.

- Details

The Central Bank (CB) has issued new directives on classification, recognition and measurement of credit facilities in licenced banks effective 1 January 2022.

- Details

Port City Colombo, the largest and most ambitious development project ever undertaken in Sri Lanka, proudly marks its seventh anniversary since the initial land reclamation work commenced in 2014.

- Details

The Colombo stock market recovered yesterday after its heavy fall on Monday with both indices up by over 1% though turnover remained low in terms of recent activity levels.

- Details

State-owned entity suffers Rs. 2.2 b monthly loss due to Govt. failure to allow price hike in LPG

Raises questions over Govt. deal with LAUGFS and recently formed LPG buying firm Siyolit Ltd.

State-owned LPG provider Litro is in crisis due to sabotage, a trade union formed to save it has warned.

- Details

Says without sizeable, secure and long-term external financing, foreign exchange reserves to continue declining over next 2 to 3 years

FX reserves data points to rising risk of debt default

Reserves well below annual external debt repayments of $ 4-5 b through at least 2025

Opines recent inflows piecemeal and boost FX reserves only temporarily and marginally given Govt.’s external repayment schedule

Expects net FDI inflows to average $ 1 b in 2021-22 compared to peak of $ 2.2 b pre-pandemic in 2018

Says recent restrictive measures may be effective in short term but could weigh on economic activity and deter investment inflows

Rating agency Moody’s yesterday declared that Sri Lanka’s foreign exchange reserves were still low and credit negative.

- Details

The Government yesterday ruled out a fuel shortage, assuring there is sufficient stock, and that public panic and speculation were unnecessary.

- Details

DHL Express, the world’s leading international express services provider, has announced an upward price adjustment of 4.9% effective 1 January 2022.

- Details

Fitch Ratings yesterday warned that finance and leasing companies were facing challenges beyond the COVID-19 pandemic.

- Details

The Export Development Board (EDB) has introduced a new financial support scheme to encourage exporters of value-added industrial products.

- Details

The Export Development Board (EDB) Chairman Suresh de Mel recently said the current unprecedented time is an opportunity to formalise the small- and medium-scale entrepreneurs (SMEs), noting that half or more are engaged in the informal sector.

- Details

Newly appointed Central Bank Governor Nivard Cabraal yesterday said a 5% growth for 2021 was likely to be a reality with the on-going vaccination drive, and mobility restrictions being relaxed.

- Details

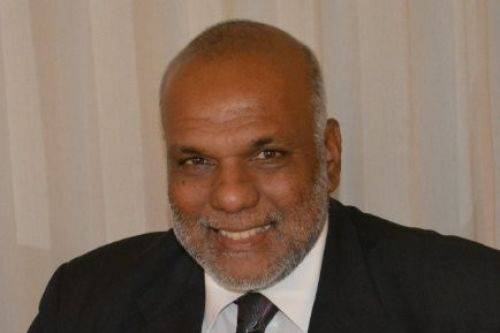

President Gotabaya Rajapaksa yesterday appointed Ajith Nivard Cabraal as the 16th Governor of the Central Bank of Sri Lanka with effect from tomorrow (15 September).

- Details

Reuters: Sri Lankan shares clocked their second consecutive weekly loss as the island nation further extended its lockdown until 1 October to tackle an upsurge in coronavirus cases.

- Details

Heightened risks from the challenging operating environment stemming from the Sri Lanka sovereign’s (CCC) weak credit profile and the ongoing COVID-19 pandemic continue to pressure the ratings of large Sri Lankan banks, says Fitch Ratings in a new report.

- Details

Sri Lanka Tourism Chief Kimarli Fernando said yesterday the country needed to take advantage of the successful vaccination program whilst relaxing guidelines in line with global best practices to revive the COVID-hit tourism industry.

- Details

Page 140 of 270