Economic

The worsening multiple economic crises have forced over 900 mills to shut, whilst also warning that rice can only be produced for another two weeks with the remaining paddy stocks.

- Details

Furore over Govt. agreeing for dollar based tariff at a time SL facing its worst forex crisis

Ceylon Electricity Board Engineers Union, Wind Power and Grid Connected Solar Power Energy Associations against the deal; warn legal action

- Details

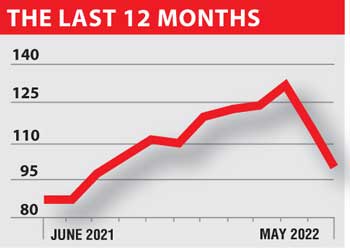

Steep shift down on yield curve

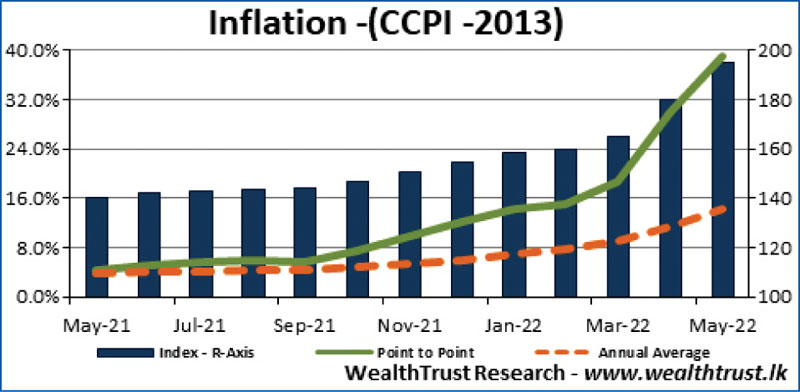

Inflation increases

Money market deficit decrease

Rupee middle rate depreciates

By Wealth Trust Securities

- Details

Says staff-level agreement with IMF likely in next four to five weeks

Stresses bridge financing key but multilateral agencies cannot repurpose till IMF deal is finalised

Hints at Sri Lanka getting as much as $ 6 b support from India

Insists painful yet critical structural reforms must be pursued to avoid future crises

- Details

ලංකා ඛණිජතෙල් නීතිගත සංස්ථාවේ නව සභාපතිවරයා ලෙස මොහමඩ් උවයිස් පත් කර තිබෙනවා. ඔහු කලක් ලංකා ඛණිජ තෙල් තොග ගබඩා පර්යන්තයේ සභාපතිවරයා ලෙස ද කටයුතු කර තිබුණා.

- Details

Says such a move will enable industry to play its part support ailing economy

Proposes govt. to liberalise industry to strengthen smallholder investment and trigger rural development

- Details

“There are no pleasant surprises as business confidence stays on its slippery course, sliding perilously into the unknown – and taking a nation’s hopes along on an unbidden ride,” business magazine LMD reported in its June edition.

- Details

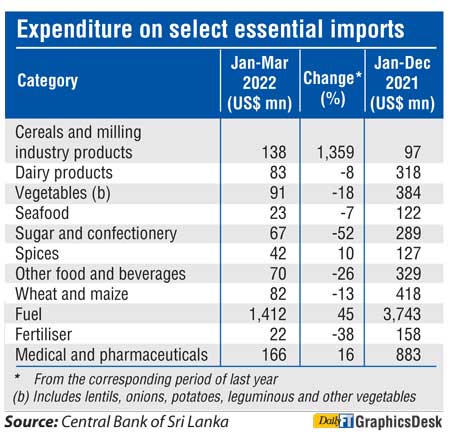

Says following restrictions imposed on payment terms and introduction of the exchange rate determination mechanism, there has been significant moderation of activity in grey market resulting in forex inflows routing through banking system

Essential Food Commodities Importers and Traders Association assures CBSL it would not resort to engage in grey market activity

Preliminary assessment underway to identify availability of stocks of essential goods at present and monthly requirement

CBSL humbly requests trading community and public to act responsibly

Says over-importation and stock piling and any over-purchasing would be undesirable

Stresses duty of all stakeholders to manage scarce foreign exchange liquidity in a calculated manner

- Details

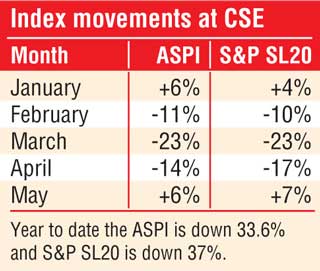

The Colombo stock market yesterday snapped a three-week upward trend as investor sentiment remained bearish.

- Details

රට අර්බුදයෙන් ගොඩ ගැනීමට නම් ණය ලබා ගැනීමට උත්සාහ කිරීම වෙනුවට ඩොලර් උපයා ගැනීම සම්බන්ධයෙන් අවධානය යොමුකළ යුතු බව ප්රකට ව්යාපාරික ධම්මික පෙරේරා මහතා පවසනවා. තවදුරටත් ලෝකයට ණයවීමෙන් මෙම අර්බුදය විසඳා ගත නොහැකි බවයි ඔහු අවධාරණය කරන්නේ.

- Details

BOI Director General Renuka Weerakoon (second from right) presents the agreement to Brown and Company Group CEO T. Sanakan. Textile venture specialists Prithiv Dorai (third from left) and Kenneth Wijesuriya (left), Aruldas Nicholas and Charitha Jayasingha (right) are also present

- Details

Cabinet Co-Spokesman Minister Bandula Gunawardena says Govt. to reduce capital expenditure via interim Budget

Opines some of the deeper realities are unavoidable as SL is trapped in multiple crises

Says no decision taken to increase State sector salaries

Affirms Govt. not keen on imposing price control on goods as it will create shortages in the market

Generalises goods price hikes and inflation as a global phenomenon

- Details

Shrugging off concerns raised by various parties that the restrictions imposed on Open Account Payment Terms would lead to a large-scale shortage of essential food items, the Central Bank yesterday assured the public that it would ensure availability of foreign exchange through the banking system for the importation of essential goods, including food items.

- Details

Page 103 of 268