Economic

First 19 days of June attracts 18,305 tourists, pushing cumulative figure to 396,826

Lowest recorded in three-week period this year from previous measly 21,102 recorded in May

Daily average arrivals further plunged to 963

India tops tourist arrivals with 3,809 followed by UK 1,924 and Australia 1,367

- Details

ජුනි මාසය අවසන් වනවිට තමාගේ ධුර කාලය අවසන් වුවද තවදුරටත් මහ බැංකු අධිපතිවරයා ලෙස රාජකාරි කිරීමට කැමැත්තෙන් පසුවන බව ආචාර්ය නන්දලාල් වීරසිංහ මහතා පවසනවා. බීබීසී මාධ්ය ආයතනය සමග සම්මුඛ සාකච්ඡාවකට එක්වෙමින් ඔහු මේ බව සඳහන් කර තිබේ.

- Details

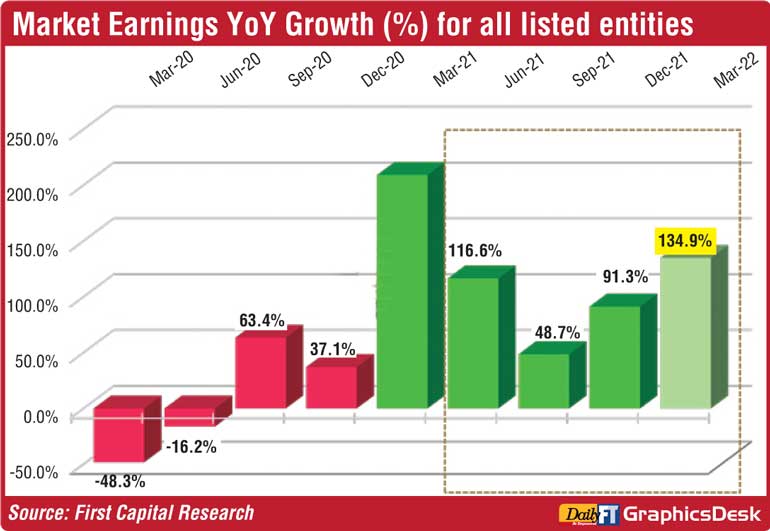

First Capital says substantial forex gains on selective counters gave a rich airbrush on quarterly earnings

Quarter-on-Quarter up 51% to Rs. 173.2 b

- Details

SINGAPORE (Reuters): Global port congestion is set to continue until at least early 2023 and keep spot freight rates elevated, logistics executives said, urging charterers to switch to long-term contracts to manage shipping costs.

- Details

Prime Minister Ranil Wickremesinghe on Wednesday met with Members of Parliament to brief them on the current economic situation.

- Details

මෙම වසරේ මුල් මාස කිහිපය තුළ මෙරට තේ අපනයනය සියයට 5 ක පමණ ප්රතිශතයකින් පහත වැටී ඇති බවයි ශ්රී ලංකා තේ මණ්ඩලය පවසනවා. එහි අධ්යක්ෂ ජනරාල් අනුර සිරිවර්ධන සඳහන් කළේ තේ නිෂ්පාදනය අඩුවීම ද මෙම තත්ත්වයට බලපා ඇති බවයි.

- Details

Korean SPA Packaging Ltd. (KSPA) has recently signed an agreement with the Board of Investment (BOI) with respect to the resumption of the operation at the defunct Embilipitiya Paper Mill, which had discontinued its production since 2012.

- Details

Makes key observations and directives during meeting to review Industries Ministry

New Industrial Policy coming up

Steps to relax rules and regulations that hinder industrial development

Govt. keen to shift from trade-dependent economy to a production system

- Details

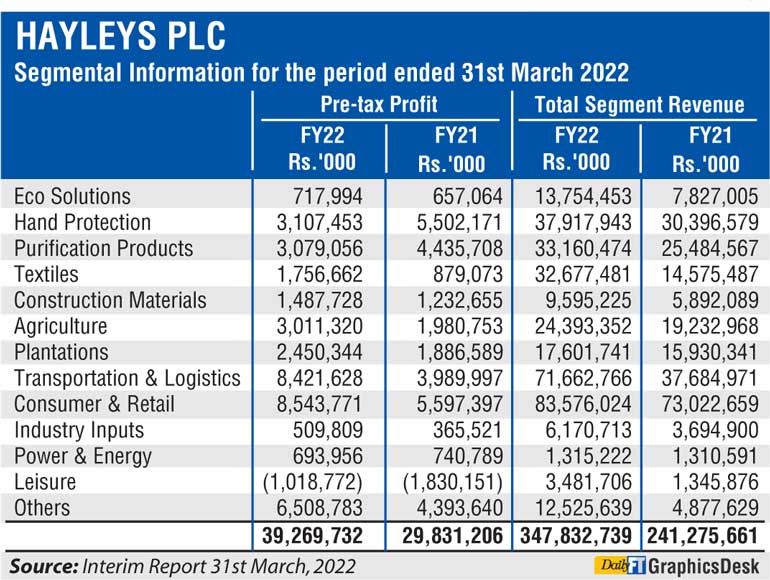

The country’s most diversified blue chip Hayleys PLC has doubled its Group after-tax profit to an all-time high of Rs. 28.1 billion in FY22.

- Details

ලංකා බැංකුව ඉතිහාසයේ වාර්තාගත රුපියල් බිලියන 43 ක බදු පෙර ලාභයක් උපයා තිබෙනවා. ණය ක්රම පුළුල් කිරීම හා දීප ව්යාප්ත සියලු ස්ථරයන් ආවරණය කෙරෙන ගණුදෙනුකරුවන්ට සමීප සේවාවක් සැපයීමෙන් අදාළ ඉලක්ක සපුරා ගෙන ඇති බවයි අනාවරණ වී ඇත්තේ. ඒ, ලංකා බැංකුවේ 2021 වාර්ෂික වාර්තාව ජනාධිපති ගෝඨාභය රාජපක්ෂ මහතා වෙත පිළිගැන්වූ අවස්ථාවේදීයි.

- Details

Says industry potential blocked by animal feed shortage and import tariffs

Insists export firms can hike production to 10,000 tons per month whilst earning 10-20 times more

Awaits favourable response from Finance Ministry on request for imported animal feed be considered as a tax rebate after export

Opines lack of local animal feed quantity remains the same for years restricting industry growth

Cites 40% of the SMEs have given up on industry amidst crisis, leading to a 40% drop in eggs production and a 30% dip in chicken output

Warns chicken and egg prices are likely to soar resulting in protein deficiencies among children

- Details

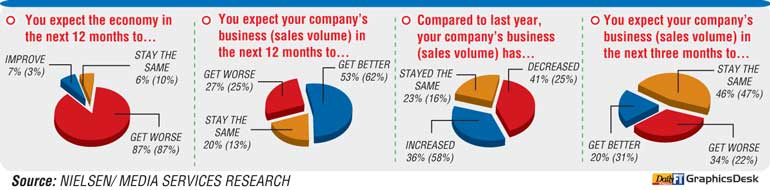

In its June edition, business magazine LMD says there’s “no hope of respite from floating rupees, fiscal storms and wolves at the door”, noting that “the May LMD-NielsenIQ Business Confidence Index (BCI) survey provides some valuable insights”.

- Details

The Cabinet of Ministers on Monday at its meeting approved the extension of controls on select capital transactions under the Foreign Exchange Act.

- Details

REUTERS: Sri Lankan shares retreated 3% yesterday to record their biggest weekly decline since late April, dragged down by industrials and financials, amid a worsening economic crisis in the country.

- Details

The Colombo stock market dipped sharply yesterday over macro concerns though turnover improved.

- Details

April sees dip for second consecutive month

CBSL says policy measures aimed at discouraging non-urgent imports and higher export growth help to narrow trade deficit for fourth consecutive month

Expenditure on imports has declined, year-on-year, for the second consecutive month in April as curb measures by the Central Bank kicked in whilst higher exports helped cut the trade deficit. Imports in April amounted to $ 1.699 billion down by 0.5%. However, April data reflects a sharper dip in comparison to $ 1.8 billion spent in March.

- Details

Page 101 of 268