The government could face risks in refinancing its debt obligations in the next five years due to various domestic and external obstacles, especially if investor sentiment changes, Moody’s Investors Service said in a new report yesterday.

“The obstacles will pose challenges to the government’s ability to refinance its large upcoming debt obligations. We analyse the implications of the country’s financing needs and options, the recent terrorist attacks and upcoming elections for Sri Lanka’s credit profile,” the report said.

In its new report, Moody’s explored the implications of the country’s financing needs and options, the recent terrorist attacks and upcoming elections for Sri Lanka’s credit profile.

“The primary challenge facing Sri Lanka (B2 stable) is its large external debt refinancing needs over the next five years, with over $3 billion principal payable annually on external government debt over 2020-2024,” says Matthew Circosta, a Moody’s Analyst.

“While a range of financing options, including international dollar bond issuance and loans from bilateral and multilateral lenders, could support refinancing, the government is highly vulnerable to sudden shifts in investor sentiment that could affect the availability and cost of these funding sources,” adds Circosta.

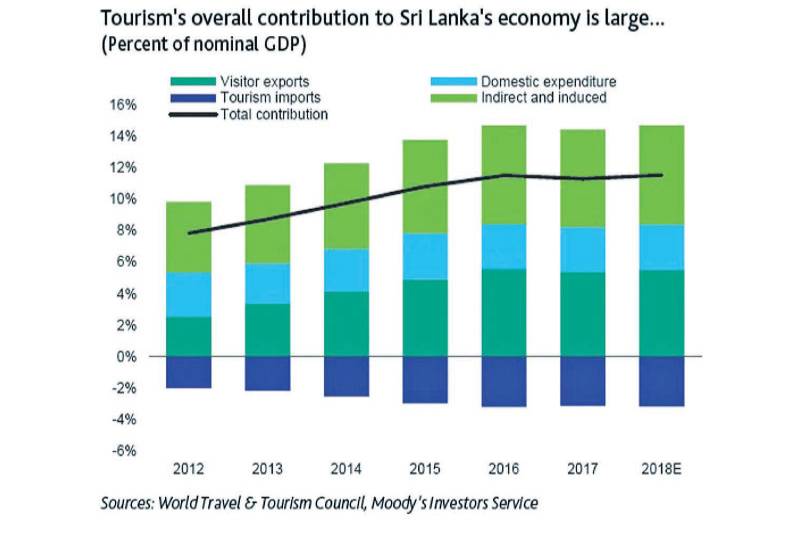

Moody’s says lower tourism arrivals and spending following the April 2019 terrorist attacks will hit GDP growth and add further pressure to public and external finances. Political tensions could also resurface before and after the presidential elections scheduled for late 2019 and the parliamentary election in 2020, with the potential to interrupt reforms and undermine investor confidence.

“We have revised down our 2019 real GDP forecast to 2.6% from our previous estimate of 3.4% based on prospects for lower tourism arrivals and spending.

Slower real and nominal GDP growth than we previously envisaged will further challenge the government’s revenue and fiscal deficit projections.”

Sri Lanka’s gross external financing needs are large, reflecting for the most part maturing government debt repayments (sovereign bond maturities, bilateral and multilateral loans, and concessional debt).

The government completed more than half of all its 2019 public external debt servicing payments in the first four months of the year. It is due to make principal payments on external debt of around $940 million from June to December 2019. Around $3 billion in external debt repayments come due in 2020, including an international sovereign bond of $1 billion in October 2020, and concessional and bilateral debt.

Overall, maturing government external debt repayments will average more than $3 billion per year over 2020-24, or around $15.4 billion in total, in addition to financing part of the budget deficit externally.

(Daily News)