Economic

The Colombo stock market remained buoyant with high turnover whilst profit-taking and a rare dip by most-valuable Expolanka failed to keep indices from gaining.

- Details

Inspects upcoming Abans refrigeration and air conditioning manufacturing plant in Milleniya Industrial Zone in Kalutara

Proposes to submit Cabinet paper to strengthen local enterprises as strategic investments

Says high time to recognise and support enterprises that are creating a culture to appreciate Sri Lankan products

- Details

Says SL’s public and external finances remain fragile; flags need for more enduring improvements

Revises down growth forecast for 2021 to 3.3% from 3.8%

Says SL can remain current on its foreign debt obligations through at least mid-2022

But tips foreign exchange reserves to decline to $ 2.5 b by 2023

SL faces $ 26 b in sovereign foreign-currency obligations due between now and 2026

Forecasts Debt-to-GDP ratio to rise to 113% by 2023 from 101% in end-2020

Fiscal deficit to widen to 12.1% of GDP by 2023 from 11.1% of GDP

- Details

Despite stating no change in policy to curtail vehicle imports, the Central Bank (CB) is likely to announce a new scheme where vehicles could be brought in without an outflow of foreign exchange from Sri Lanka.

- Details

Bespoke luxury fashion brand Kelly Felder has become the first major brand in the country to accept cryptocurrency through the 10-year-old leading blockchain payment provider BitPay. “As the digital age evolves, we strive to move forward with these advances exposing our businesses as well as Sri Lanka to high potential opportunities such as cryptocurrency,” Kelly Felder Head of E-Commerce and Strategy Dinith Wickramanayake said. “It is an honour to be a pioneer in digital transformation, paving the way for the retail and fashion industry by being the first renowned Sri Lankan brand to accept crypto currencies through Bitpay.”

- Details

Lists measures to shore up foreign reserves; lists ongoing and planned multi-billion initiatives

- Details

The Court of Appeal last week took up the petition alleging corruption during the award of a tender to affix tax stamps on alcohol, and issued notice to all respondents of the case, including Finance Minister Basil Rajapaksa, Treasury Secretary Sajith Attygalle, the Commissioner General of Excise and Madras Security Printers in India.

- Details

Central Bank Governor Nivard Cabraal yesterday held what he described as a “fruitful discussion” with Qatar Central Bank Governor Sheikh Al-Thani, one of the longest-serving governors in the world.

- Details

CBSL Chief Cabraal believes new dedicated mobile app and benefits could increase annual workers remittances inflow by a further $ 2 b to $ 9 b

Sept 2021 remittances almost halved to $ 353 m from a year ago; nine months figure down by 9% to $ 4.5 b

- Details

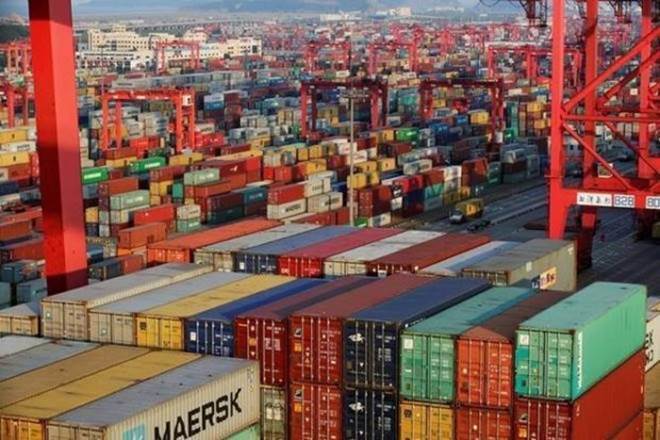

Economic and financial experts say that shipping rates, which have risen significantly so far, will continue for some time, leading to higher prices of imported goods.

- Details

The Government yesterday presented a Bill to Parliament to amend the Appropriation Act No. 7 of 2020 to increase the borrowing limit of Rs. 2,997 billion to Rs. 3397 billion.

- Details

Nearly 16,500 tourists have arrived in the country between 1 and 24 October, boosting hopes for the crisis-ridden industry.

- Details

The Colombo stock market sustained its bullish sentiment with the benchmark All Share Price Index touching the magical 10,000-point level though closing lower amidst improved turnover.

- Details

ASPI crosses 9,800 points to close at a new high

CSE sees net foreign inflow of Rs. 41 m

ASPI and S&P SL20 up YTD by 45.87% and 35.43% respectively

Expolanka crosses Rs. 200 mark again

- Details

Tourism Minister Prasanna Ranatunga chairs a special meeting of the Board of Directors of Sri Lanka Tourism Promotion Bureau along with officials yesterday

- Details

Consumer Protection State Minister says no decision taken to re-impose MRP

Sugar sold at higher prices, as retailers ignore MRP and stricter laws and fines

Rice prices up once again as per mill owners

- Details

The country’s manufacturing and services sector bounced back in September after suffering a sharp dip in August.

- Details

Page 135 of 270