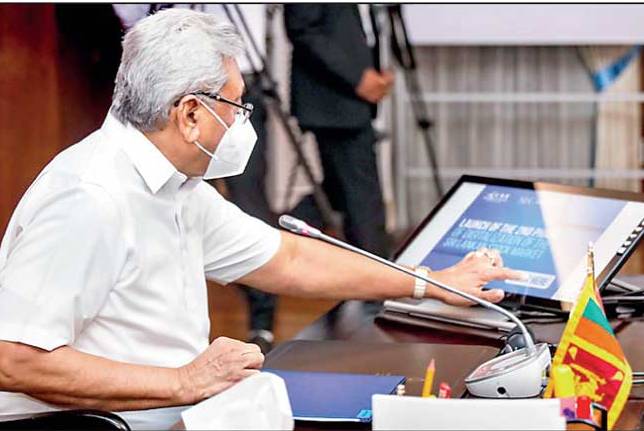

President Gotabaya Rajapaksa has kicked off the second phase of the highly beneficial digitalisation of the stock market an initiative jointly championed by the Securities and Exchange Commission of Sri Lanka (SEC) and the Colombo Stock Exchange (CSE).

The event was attended by Secretary to President Dr. P.B Jayasundara, SEC Chairman Viraj Dayaratne PC, CSE Chairman Dumith Fernando, SEC Commission Member Manil Jayesinghe, Digitalisation Committee Chairman and SEC Commission Member Naresh Abeyesekera, SEC Director-General Chinthaka Mendis, CSE Director Jayantha Fernando, CSE Chief Executive Officer Rajeeva Bandaranaike, SEC Surveillance and Acting Director Capital Market Development and Director Prabash Wanigatunge, and CSE Chief Information Officer Chandrakanth Jayasinghe.

Following the COVID-19 outbreak in Sri Lanka in March 2020, the need to further digitise the operations of the stock market to ensure uninterrupted access, increase investor participation, enhance operational efficiencies and service standards became a top priority. The digitalisation initiative is expected to be completed in three phases and is a collaborative effort of a joint committee comprising of both the SEC and the CSE members appointed by the SEC Chairman.

On 17 September 2020, a special ceremony was held under the auspices of Prime Minister Mahinda Rajapaksa to launch the first phase, which included customer onboarding to trade confirmation and execution of corporate actions.

Since the completion of the first phase of digitalisation and the launch of the mobile application, total app downloads exceeded 65,000 and approximately 17,000 new Central Depository System (CDS) accounts were opened via the mobile app. Moreover, 97% of the total local individual accounts opened were through the app and 84% of the total accounts opened were by those aged 18-40.

The app has become one of the fastest-growing in Sri Lanka, reaching 21 million smartphones nationwide. This sharp rise in retail investor participation implies that digitalisation of the stock market operations has been able to reach a large section of the more technologically savvy investors.

The second phase of the digitalisation initiative is expected to cater to the needs of more stakeholders, including investors, issuers and stockbrokers.

Stockbrokers will be in a position to increase efficiency and reduce the cost of printing, preparing and dissemination of forms to clients and reach more effectively to a broader and more diverse section of the public.

The new CSE mobile app, a comprehensive investor platform, will grant access to investor portfolios from any part of the world, enable viewing of past transactions and monthly statements as well as provide investors with a host of other benefits, including the ability to request changes to master files, research reports and content that aims at significantly simplifying the investment experience, create greater value for investors, as well as for the long-term development of the market.

The latest features of the mobile app include CDS eConnect, MYCSE benefitting a wide range of stakeholders of the stock market. CSE website also features ‘Investo’ the CSE trilingual chatbot or the voice assistant function with the second phase of digitalisation, enabling a productive user experience with increased expediency.

This initiative will also enable local companies to open CDS accounts through the mobile app and enable investors to apply for IPOs from anywhere as well as assess the progress of their IPO applications.

Going forward, further digitalisation of the stock market, with the third phase due to be completed by the fourth quarter of 2021, remains a key agenda for the SEC and the CSE in order to establish a more innovative, efficient and inclusive securities market with a well-secured vanguard technological framework which is in line with the Government’s agenda. Sri Lanka is poised to benefit greatly from this digital revolution and take the country to the next level of economic growth.

(FT)