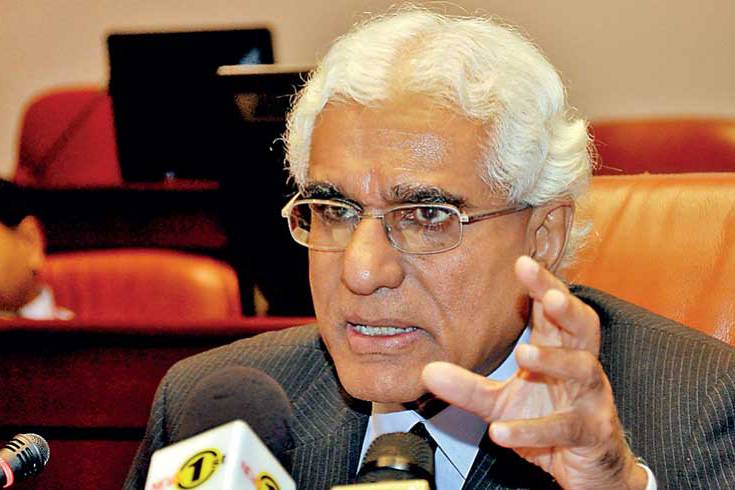

The Sri Lankan economy and its tourism sector will be able to withstand the shock from the Easter Sunday terror attacks according to Central Bank Governor Dr. Indrajit Coomaraswamy, who spent most of his career behind the scenes, working meticulously to give strength and structure to a fragile front line market.

The task of putting the terror affected economy back on track is now vested in Dr. Coomaraswamy who possessed a degree at Cambridge University and a doctorate in economics at the University of Sussex.

He was a brilliant leader and a flashy and tactical wing forward who led Sri Lanka rugby with distinction facing international giants courageously in 1970s and captained cricket in Harrow School in England in1967/1968 he also captained junior cricket at Royal college Colombo .

He is fair to all but tough in setting a code of conduct and uncompromising when it came to quality of play in rugby and it has not changed in handling the Central Bank’s monetary affairs.

Dr Coomarswamy is now leading the Central Bank pack using his prowess similar to the manner when he guided the country to glory to emerge second to mighty Japan in the 1974 Rugby Asiad played at Longden Place in 1974 before a wildly cheering full house of rugby fans.

He led the team to remain unbeaten with victories over Malaysia, Laos and Singapore in Group ‘A’. Group ’B’ comprised Japan, Thailand, Hong Kong and South Korea.

Now all Sri Lankans including the still surviving hundreds of his rugby fans who cheered him are eagerly waiting for his action towards economic recovery path without downgrading the country’s GDP growth prospects for 2019 which stand at 3.5-4%.

The jewel in his recent career as the Central Bank Governor was the regaining of the International Monetary Fund’s (IMF) Extended Fund Facility (EFF) of US$1.5 billion after its suspension since the instigation of political impasse by the President on October 26 last year.

Upon the granting of waivers of non observance for the end December 2018 performance criteria on the primary balance and net official international reserves, the IMF makes available SDR 118.5 million (about US$ 164.1 million), bringing total disbursements under the arrangement to SDR 833.73 million (about US$ 1.155 billion).

The IMF Executive Board also approved an extension of the arrangement by one additional year, until June 2, 2020, with re phasing of remaining disbursements following tough negations.

This writer still remembers his initial prowess in cricket at Royal primary Colombo as the captain of Royal junior school as well as in Club cricket as an all rounder, right hand batsman and left arm spinner who played for the Tamil Union as vice captain to S.Skandakumar another outstanding Royalist and later his involvement in the tough negotiations with international donor agencies during President J.R Jayawardene’s regime.

He was Former Finance Minister Ronie De Mel’s trusted lieutenant in implementing free economy who was secondment to the Ministry of Finance and Planning in the last eight years of his central bank tenure began in 1974, where he was a member of the Sri Lanka delegation to the Commonwealth Finance Ministers Meeting, IMF/World Bank annual meetings, the Spring Meetings etc in late 1970s to 1980s.

After his return to the helm of the Central Bank, he took over responsibility of restoring integrity to the bank and to the government

Without any personnel agendas, he took far reaching correct decisions at the right time and did all the right things in a difficult political environment.

The Central Bank of Sri Lanka continues to pursue a prudent and data-dependent monetary policy.

The amendments to the monetary law will be a major step in the transition to flexible inflation targeting.

Efforts to build reserves should be sustained, under greater exchange rate flexibility, to protect the economy against shocks.

Harmonizing regulation and supervision of financial institutions, strengthening the macro prudential policy framework, and enhancing the crisis-preparedness toolkit will help further strengthen financial sector stability.

“Continued implementation of structural reforms is essential to support strong and inclusive growth. Efforts should focus on liberalizing trade, improving the business environment and promoting investment, strengthening governance, encouraging female and youth labor force participation, enhancing social protection, and improving crisis preparedness to natural disasters.

All these tasks stipulated by the IMF will be fulfilled this economist by training who spent more than 40 years moving around the upper stratum of Sri Lanka’s civil service, advising a renowned finance minister who was instrumental in changing the closed economy to free economy and guiding present prime minister between 2001 and 2002 and again in 2015 as an advisor at the Ministry of Development Strategies and International Trade after enjoying 16 years with the Central Bank.

(LI)