Economic

Central Bank Governor Dr. Indrajit Coomaraswamy yesterday defended the monetary authority’s decision to impose caps on interest lending rates, insisting that it was an effort aimed at giving a strong tailwind to the economy to grow post-March once the election cycle was over.

- Details

Sri Lanka Central Bank has taken several key initiatives to promote cashless payments including mobile payments while strengthening electronic retail payment infrastructure.

- Details

Bank of Ceylon has written off Rs. 1,169 million capital of loans obtained by s 12,014 customers of the Bank in 2017/2018 period , latest data showed.

- Details

The Central Bank of Sri Lanka has taken a number of measures over the past eleven months to ease monetary policy and monetary conditions in view of decelerating growth of credit and monetary aggregates and subdued economic growth, amidst well anchored inflation expectations.

- Details

A five year Tourism Value Chain is to be created in Sri Lanka with Canadian funding to promote tourism focusing on Small and Medium Enterprise (SME) schemes that impact the lively hood of rural women folk country wide

- Details

Details of a financial fraud of withdrawing cash from National Savings Bank fixed deposits belonging to Postgraduate Institute of Science (PGIS) Peredeniya University have been revealed.

- Details

ශ්රී ලංකාවේ වඩාත්ම සාර්ථක සහ විශ්වාසදායී දේපල සංවර්ධන ආයතනය වන ප්රයිම් සමුහය කොළඹ සහ ඒ අවට සුවපහසු නාගරික ජීවිතයට කැමති සිය පාරිභෝගිකයන් වෙනුවෙන් වර්ෂ 2014 සිට සුපිරි නිවාස සංකීර්ණ 32 ක් නිම කර දී ඇති බව නිවේදනය කරයි.

- Details

බ්රැන්ඩික්ස් සමාගම මෙරට ආර්ථිකයට ලබා දුන් සුවිශේෂී දායකත්වය වෙනුවෙන් යළිත් වරක් ‘වසරේ අපනයනකරු’ ලෙස ජනාධිපති සම්මානයෙන් පිදුම් ලැබීමට පසුගිය දා සමත් විය. 23වැනි වරට පැවැති මේ සම්මාන උළෙල ජනාධිපති මෛත්රීපාල සිරිසේන මහතාගේ ප්රධානත්වයෙන් පැවැත්විණි.

- Details

මහ බැංකුකරණය පිළිබඳ වෙනස් ලෙස සිතීම වචනයේ පරිසමාප්ත අර්ථයෙන්ම ඉටු කරමින් අග්නිදිග ආසියානු මහ බැංකු ආයතනයේ දී සියැසන් (SEACEN) සහ අන්තර්ජාතික පියවීම් බැංකුවෙහි (Bank for International Settlements - BIS) උසස් මට්ටමේ සම්මන්ත්රණය සහ සියැසන් විධායක කමිටුවේ 18 වැනි රැස්වීම අතිසාර්ථකව කොළඹ දී පැවැත්වීය.

- Details

Reuters: Stocks and rupee closed firmer yesterday after presidential frontrunner Gotabaya Rajapaksa, who faced uncertainty over his candidature, filed a nomination early in the day.

- Details

REUTERS: Sri Lanka’s stocks recovered on Friday from a more than 10-week closing low hit in the previous session, while the rupee finished steady ahead of a key court decision on the presidential frontrunner Gotabaya Rajapaksa.

- Details

Inroads made by fintech will push stakeholders to redraw the roadmap for the banking industry, which would require focus on increasing the agility of banks, improving financial inclusion and accelerate development, an official said.

- Details

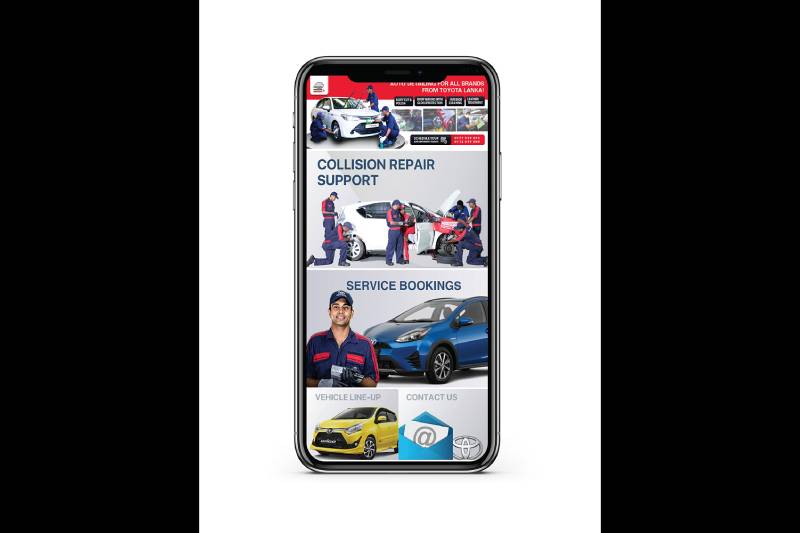

Toyota Lanka (Pvt) Ltd, the sole authorized distributor for Toyota vehicles and genuine spare parts in Sri Lanka, recently launched a comprehensive website for Toyota Sure certified vehicles which are approved by Toyota Motor Corporation and exported to Sri Lanka.

- Details

Tourism authorities yesterday attributed the 27% dip in tourist arrivals to 108, 575 during September to the lean period, although they earlier projected 150,000 with the hosting of the Global Bohra Convention in Colombo.

- Details

SriLankan Engineering, the aircraft Maintenance Repair Overhaulunit (MRO) of SriLankan Airlines, marked another milestone with the commencement of certification of the first B787 aircraft operated by Singapore Airlines to Malé, Maldives. The Airline in the past has provided certifications to various Airbus aircraft of Singapore Airlines in Maldives and this is the first time the National Carrier certified a Boeing 787.

- Details

ශ්රී ලංකා ජාත්යන්තර වාණිජ මණ්ඩලය (ICCSL) සහ ශ්රී ලංකා කළමනාකරණ ගණකාධිකාරීන්ගේ වරලත් ආයතනය (CIMA) මගින් 2019 වසරේදීත් අඛණ්ඩව දෙවැනි වරට ශ්රී ලංකාවේ වඩාත්ම ගෞරවාදරයට පත් සමාගම් 10 අතරට ශ්රේණිගත වීමට එයිට්කන් ස්පෙන්ස් පීඑල්සී සමත් විය.

- Details

රුපියල් මිලියන 12000ක මුදලක් ලබා ගැනීමට ශ්රී ලංකා මහ බැංකුවේ රාජ්ය ණය දෙපාර්තමේන්තුව විසින් ඉකුත් 02 වැනිදා ඉදිරිපත් කළ භාණ්ඩාගාර බිල්පත් වෙන්දේසියට අධි ඉල්ලුක් ලැබී තිබේ.

- Details

Page 248 of 271