Economic

The Government yesterday confirmed that the reopening of Sri Lanka’s borders on 26 December is a pilot project and not a formal opening to welcome international travellers post-COVID, with the official lifting of restrictions slated for January.

- Details

Central Bank has directed all licensed commercial banks and National Savings Bank to suspend the purchase of Sri Lanka International Sovereign Bonds (ISBs) for six months unless such purchase is funded by new foreign currency inflows sourced from abroad.

- Details

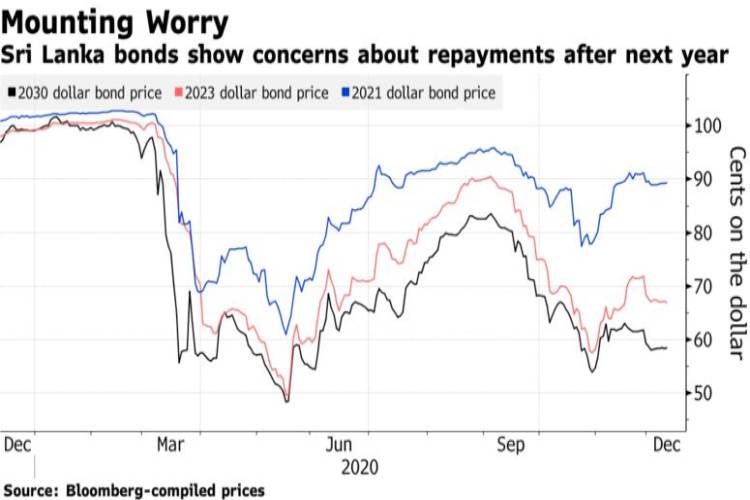

Global financial giant Citi has cautioned Sri Lanka that its denial of a debt crisis shouldn’t be a strategy, and called for effective restructuring and boosting of income streams.

- Details

Cabinet yesterday approved Rs. 365 million to construct an International Gem and Jewellery Trade Centre in Ratnapura to develop the industry.

- Details

The Sri Lanka Tea Board (SLTB) has allocated Rs. 450 million for several fresh development initiatives hoping for a gradual shift towards enhancing the yield and quality of Ceylon Tea by encouraging additional 50 million new plants by next year.

- Details

Global financial giant Citi’s research arm is forecasting Sri Lanka’s economy to contract by 4% this year before rebounding to a 3% growth in 2021.

- Details

Suresh de Mel, a well-known entrepreneur, assumed duties as the new Chairman of the Sri Lanka Export Development Board (EDB) yesterday.

- Details

Local importers have expressed their concerns over the Cabinet’s decision to extend the validity period of the order issued under the Foreign Exchange Act regarding the restriction on outflows of foreign exchange by six months.

- Details

Two Non-Executive Directors have resigned from the Board of the Bank of Ceylon (BOC) with effect from 8 December.

- Details

Workers’ remittances recorded a growth of 3.9% in October 2020, year-on-year, to $ 631 million, the Central Bank said yesterday.

- Details

Launching a broadside against multiple agencies warning of Sri Lanka’s debt sustainability, State Minister of Money and Capital Markets and State Enterprise Reforms Ajith Nivard Cabraal yesterday questioned their independence and expressed confidence investors would not be distracted by their “ill-advised and subjective” statements.

- Details

The Colombo stock market yesterday completed 12 consecutive days of gains showing consistency whilst turnover hit a new high of Rs. 5.3 billion as investor sentiments gathered more momentum.

- Details

Cumulative net outflow from rupee-denominated Government securities rose to $ 523 million in October, the Central Bank said yesterday, but emphasised exposure remained low.

- Details

Signalling intent to turnaround sluggish growth by boosting demand the Finance Ministry yesterday said it would immediately begin implementing a slew of Budget proposals targeted at providing relief to public sector workers, Small and Medium Enterprises (SMEs), youth, dairy farmers and students.

- Details

State-owned giant Bank of Ceylon (BOC) has succeeded in enjoying growth in its inward remittances business.

- Details

The National Carrier of Sri Lanka and a member of the oneworld Alliance, SriLankan Airlines is set to increase the frequency of passenger flights from Colombo to Singapore from once a week to thrice a week, commencing 18 December.

- Details

Markets are showing mounting concern about Sri Lanka’s ability to manage debt loads, amid financial deterioration that sparked a downgrade deeper into junk Friday.

- Details

State-of-the-art cement manufacturing facility Lanwa Sanstha Cement Corporation Ltd., which is slated to be one of the largest in the region, is scheduled for commissioning in June 2021. The facility, spread across 63 acres, is in the Mirijjawila Export Processing Zone, Hambantota.

- Details

Page 180 of 270