Economic

Headline inflation as measured by the year-on-year (Y-o-Y) change in the National Consumer Price Index (NCPI, 2013=100)1 decreased to 5.2% in November 2020 from 5.5% in October 2020, the Central Bank said yesterday.

- Details

Sri Lanka’s growth prospects for 2021 had dimmed from the 5 percent levels expected in October amid a surge in Corona virus and with the Census and statistics latest controversial data released with much delay, economic analysts said.

- Details

Reuters: Shares fell the most in a month on Thursday, dragged down by losses in consumer staples and industrial stocks.

- Details

The Free Trade Zone Manufacturer’s Association (FTZMA) yesterday called on the Government not to change the compensation ceiling of Rs.1.25 million given to terminated employees as such a move would place additional pressure on employees already struggling with COVID-19.

- Details

Uber yesterday (18) announced the installation of safety screens or safety ‘cockpits,’ a protective ceiling-to-floor transparent plastic screen between the passenger and the driver, in over 1,500 cars and tuks, setting a new standard of safety in the ‘new normal.’ Additionally, these safety screens are being scaled up across product categories immediately.

- Details

නීතිවිරෝධී අන්දමින් ස්පා ආයතන පවත්වාගෙන යාම හා තාවකාලික කාමර සේවාවන් සැපයීම හේතුවෙන් ඉදිරියේදී ස්පා පොකුරු හා කාමර පොකුරු මතුවීමේ දැඩි අවදානමක් මතුව ඇතැයි මහජන සෞඛ්ය පරීක්ෂකවරුන්ගේ සංගමයේ ලේකම් මහේන්ද්ර බාලසූරිය පැවසීය.

- Details

The Hotels Association of Sri Lanka (THASL) on Friday welcomed the new initiatives to boost tourism, whilst making key suggestions for better revival post COVID-19 pandemic.

- Details

Low growth, macroeconomic issues, muted private sector growth to impact banks

Despite projections of 4.9% growth in 2021 underlying vulnerabilities and COVID-19 to affect profitability

Growth expected to contract 6.7% in 2020

Despite spate of relief measures by CB, impaired loan ratios on the rise

- Details

Growth rebounded to 1.5% in the 3Q after a severe contraction of 16.3% in 2Q, the Census and Statistics Department (CSD) said yesterday, releasing long-awaited data, which also revised slightly down the 1Q growth from -1.6% to -1.7%. The latest data indicates that Sri Lanka’s growth contracted 5.3% for the first three quarters for 2020 and could end the year with further downward growth given the partial curfews imposed due to the second COVID-19 wave in October. In its mid-year forecast the Central Bank predicted a contraction of 1.7% for the entire year while Budget 2021 has predicted a robust turnaround of 5.5% growth for next year.

- Details

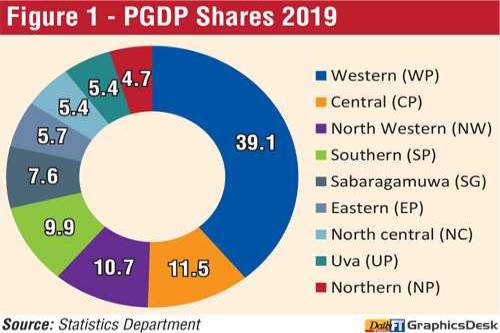

Cementing its track record as the richest region in the country, the Western Province contributed the highest share of 39.1% to Sri Lanka’s nominal GDP in 2019 but was down 0.5% from the previous year, while the Central and North Western Provinces followed at a distant second and third place, latest data from the Central Bank showed.

- Details

SriLankan Catering yesterday confirmed media reports stating that eight employees of the airline at SriLankan Catering operations division at the Bandaranaike International Airport had tested positive for the COVID-19 virus.

- Details

The Manufacturing sector rebounded in November with an increase of 17 index points as concerns of COVID-19 eased but even though the Services sector edged up compared to the previous month, it remained below the threshold level, the latest Purchasing Managers Index (PMI) released by the Central Bank said yesterday.

- Details

The US Department of State, Bureau of Democracy, Human Rights and Labor (DRL) has announced an open competition for organizations interested in submitting applications for projects that advance and protect freedom of association and freedom of assembly in Sri Lanka.

- Details

ලංකා ඛණිජ තෙල් නීතිගත සංස්ථාවේ ඉන්ධන අළෙවිය මේ වසරේ මුල් මාස 8 තුළදී 20% කින් පහත වැටී ඇතැයි රාජ්ය මූල්ය කළමණාකරණ දෙපාර්තමේන්තුව වාර්තා කරයි. මෙම කාලය තුළදී සංස්ථාවේ අලාභය රුපියල් බිලියන 4.4 ක් හෙවත් කෝටි 440 කි.

- Details

President Gotabaya Rajapaksa has bac-ked the Board of Investment (BoI) and Power Ministry to combine forces to attract investment into the electricity generation sector, particularly renewables, calling for expeditious implementation of projects, the President’s Media Division (PMD) said in a statement yesterday.

- Details

The Colombo Stock Exchange (CSE) announces several changes in S&P Sri Lanka 20 index constituents made by S&P Dow Jones Indices at the 2020 year-end index rebalance.

- Details

The development of the Port City took a significant step yesterday, with Browns Investments PLC entering into a landmark agreement with China Harbour Engineering Company (CHEC) to commence the Colombo International Finance Centre mixed development project, which will involve an investment of $ 450 million.

- Details

Reuters: Shares ended lower on Tuesday, after 15 straight sessions of gains, dragged down by losses in financial stocks.

- Details

Page 179 of 270