Economic

Renewed buying by investors saw the Colombo Stock Market produce a strong late rally yesterday, helping the benchmark index close on the up after having dipped by 1.7% earlier on, in a development reinforcing the new resilience. Profit taking continued from Tuesday when market opened yesterday triggering a free fall in the first half of trading. However, having fallen by 136 points or 1.7%, fresh round of buying ensured a stellar late sustained rally. This enabled ASPI to rise by 212 points from its intra-day low to close on the up 75 points or 1%. The more active S&P SL20 was erratic earlier on but ended closing up 37 points or 1.22%.

- Details

Controlling shareholder Melstacorp PLC last week sold a small stake in Distilleries Company of Sri Lanka PLC (DCSL) for Rs. 18 million.

- Details

Hit by a downturn in economic activity due to the second COVID-19 wave Sri Lanka’s trade deficit in November shrank by $ 198 million while overall it recorded a reduction of $ 1.79 billion for the first 11 months of 2020, latest data from the Central Bank showed yesterday.

- Details

The beleaguered COVID-hit tourism industry will start today with fresh hope for revival as Sri Lanka reopens its borders after a 10-month closure though actual leisure travellers to exotic destination may take bit longer.

- Details

The Colombo stock market yesterday became the world’s best performing among primaries as it soared to all-time level, breaking a 10-year-old record, with heightened bullish investor activity propelling turnover to over Rs. 12 billion for the second consecutive session.

- Details

Reuters: Financial and industrial stocks boosted Sri Lankan shares nearly 4% higher yesterday, a day after the stock market was closed for a holiday.

- Details

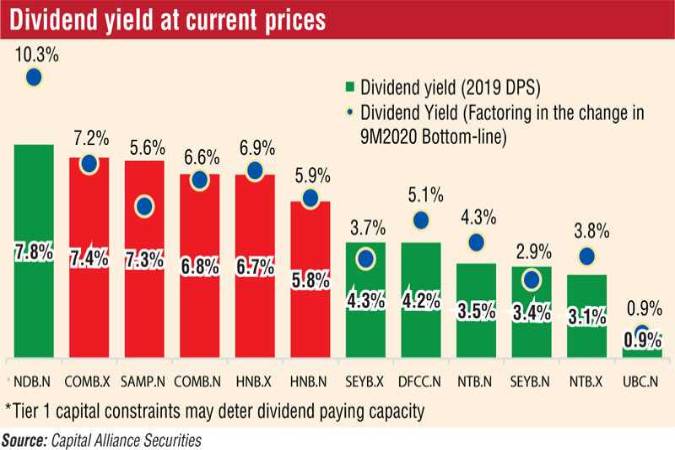

Central Bank in its latest circular has reversed a decision given in May last year and allowed licensed commercial and specialised banks to pay dividends post-finalisation of annual accounts, which typically takes place around February.

- Details

Market performance has proven Sri Lanka’s depth and, together with other Government policies, sets the stage for the country to aspire to the next level of development, State Minister of Finance, Capital Markets and State Enterprise Reforms Ajith Nivard Cabraal said yesterday.

- Details

Workers’ remittances recorded a notable increase in November 2020, rising 18.7% to $ 612 million and increasing the total for the first 11 months to $ 6.2 billion.

- Details

Ministry of Urban Development and Housing is to write off 50% of the arrears owed by shop owners at the Colombo Race Course Grounds, which have been disrupted due to the COVID-19 pandemic.

- Details

The Central Bank yesterday said $ 543 million outflow of foreign investment was observed from the rupee-denominated government securities market in the period up to November.

- Details

World-renowned financier and a member of the Rothschild family, Nathaniel Rothschild who is in Sri Lanka for a brief business tour, paid a visit to the Port City – Colombo yesterday.

- Details

Joining the effort to propel Sri Lanka to 6% growth in 2021 the Central Bank has decided to keep policy rates unchanged and will introduce priority sector lending targets for Micro, Small and Medium

- Details

The Securities and Exchange Commission of Sri Lanka (SEC) in a statement yesterday welcomed the record-breaking performance of the Colombo Stock Exchange (CSE).

- Details

State Minister for Capital Markets Nivard Cabraal yesterday said he is naturally pleased Bloomberg has called CSE the second best performing equity market in the world.

- Details

The Tourism Ministry yesterday confirmed that the foreign exchange earned from the pilot project of Ukrainian tourist arrivals was Rs. 420 million.

- Details

Workers’ remittances recorded a notable increase in November 2020, rising 18.7% to $ 612 million and increasing the total for the first 11 months to $ 6.2 billion.

- Details

The Import and Export Control Department has issued fresh operating instructions to all commercial banks on advance payment in foreign currency, and the clearing of imported goods to the country.

- Details

Page 174 of 270